“Policy consistency is now an asset,” IPPFA Sdn Bhd director of investment strategy and country economist Sedek Jantan said, citing Bank Negara Malaysia’s (BNM) monetary policy committee decision to maintain the overnight policy rate at 2.75% during its meeting last Thursday.

He said markets see BNM as predictable, non-reactive and disciplined, which is interpreted as monetary policy no longer being viewed as a source of foreign exchange (FX) risk.

“Malaysia is being quietly reclassified into that ‘quality Asian emerging market’ bucket.

“Markets are pricing Malaysia less as a ‘China proxy’ and more as a semiconductor and artificial intelligence adjacent manufacturing hub, as well as a beneficiary of supply-chain rerouting,” he told Bernama.

He added that what matters is not the FX call itself, but the recognition that Malaysia’s currency is now being supported by structural drivers, investments, exports and policy credibility, rather than external monetary cycles alone.

Meanwhile, Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid told Bernama that the ringgit continued to stage a commendable performance today, with another reason being talks of possible intervention by the Japanese government and the Federal Reserve to stabilise the yen, which led to positive sentiment in the foreign exchange market.

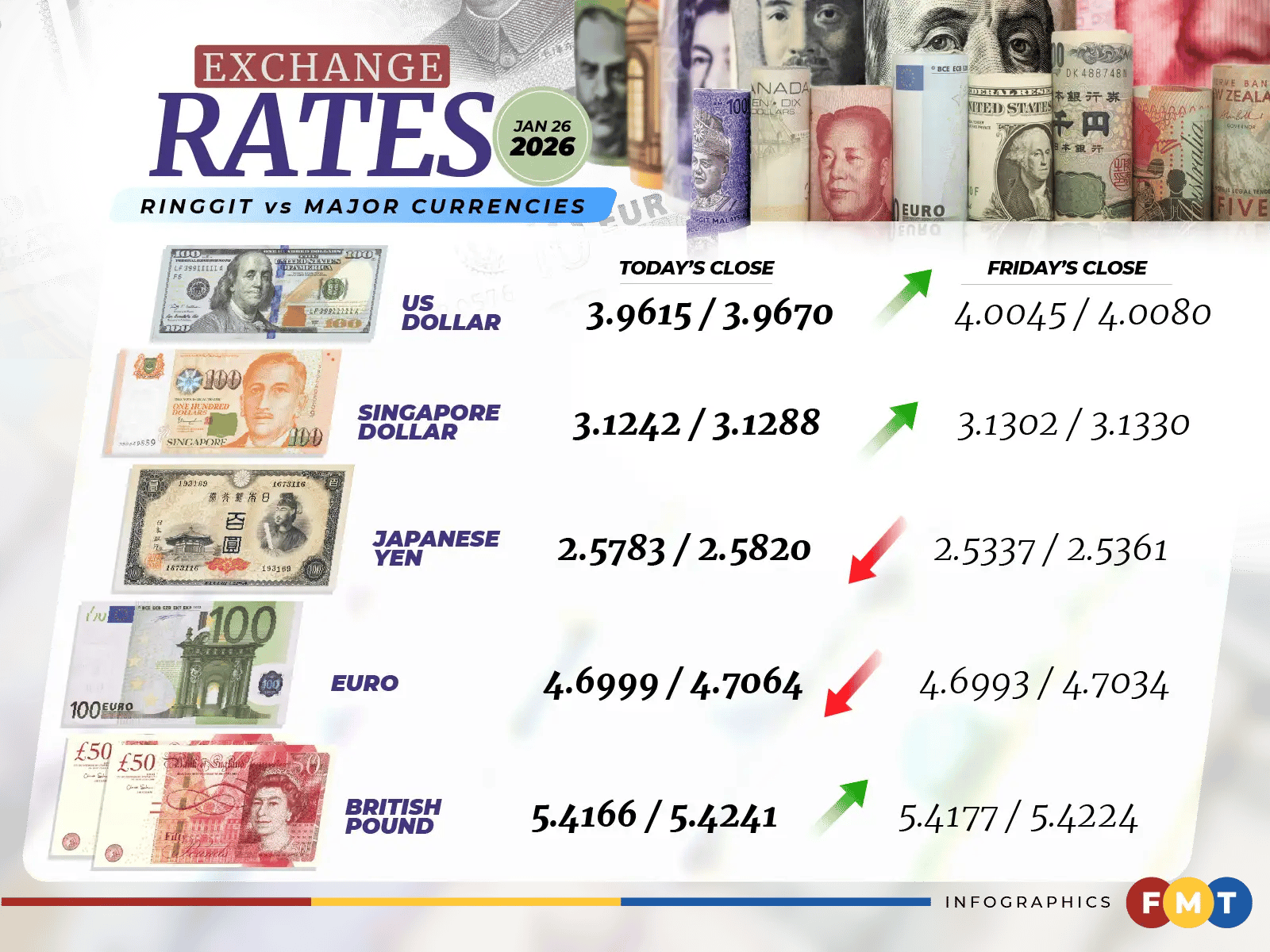

At 6pm, the ringgit was quoted at 3.9615/3.9670, slightly over 1% higher than the greenback from 4.0045/4.0080 at last Friday’s close.

It was last seen at this level in May 2018.

The ringgit appreciated against the British pound to 5.4166/5.4241 from 5.4177/5.4224, but eased vis-à-vis the euro to 4.6999/4.7064 from 4.6993/4.7034 and weakened versus the Japanese yen to 2.5783/2.5820 from 2.5337/2.5361 last Friday.

It strengthened against the Singapore dollar to 3.1242/3.1288 from 3.1302/3.1330, advanced versus the Thai baht to 12.7441/12.7679 from 12.8362/12.8544, gained vis-à-vis the Indonesian rupiah to 236.0/236.4 from 238.0/238.3 and surged against the Philippine peso to 6.72/6.73 from 6.77/6.78 previously.