This is something that Sotheby’s recently fell foul of when a Canadian company sued the auction house and crypto-artist Kevin McCoy following the sale of one of his NFTs.

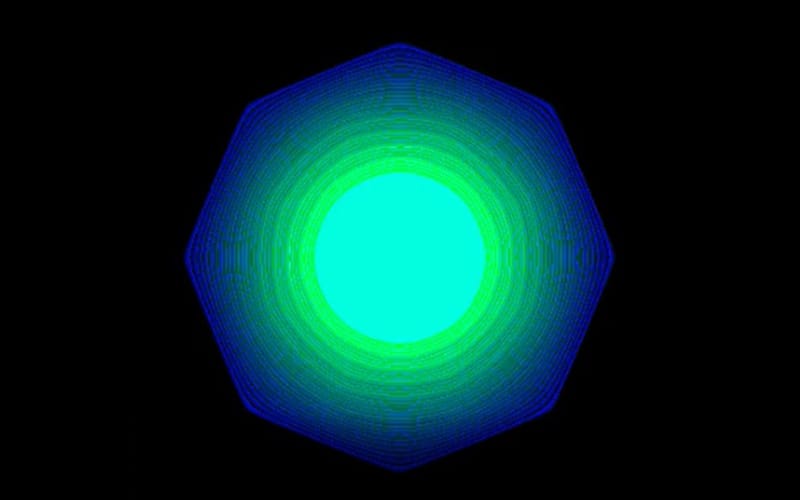

The NFT in question is “Quantum.”

This octagon-shaped animation became the first work to have an NFT-like ownership certificate attached to it, in May 2014.

The term “Non-Fungible Token” was not coined until three years later.

“Quantum” sold in June 2021 for US$1.47 million at the Sotheby’s “Natively Digital” auction.

“So happy to own the first ever NFT, Quantum, from @mccoyspace. A piece of history. Now let’s see how we can continue its story,” said internet user @sillytuna on Twitter following the sale.

According to the specialist media Ledger Insights, the Canadian company Free Holdings filed a complaint a few months later with the US District Court for the Southern District of New York.

It claims to be the owner of the original NFT of “Quantum.”

This digital work was turned into an NFT, or “minted” in tech jargon, on NameCoin.

This blockchain is derived from the computer code of Bitcoin, the king of cryptocurrencies. NameCoins must be renewed every 250 days or so, just like when you register a domain name.

Kevin McCoy reportedly did not renew “Quantum” the year after it was created, meaning that anyone could claim ownership.

According to Ledger Insights, no one would have done so until the digital media outlet Axios published an article on this NFT in March 2021.

An internet user known under the pseudonym @EarlyNFT supposedly then re-registered it on NameCoin and reportedly tried to contact Kevin McCoy on Twitter, before the “Natively Digital” sale.

A market rife with fraud, spam and plagiarism

The user is now suing the artist, Sotheby’s and the company Nameless, which wrote the condition report for “Quantum” for the auction house.

It notably states that the NameCoin associated with this digital work “was removed from the system after not being renewed, and was effectively burned from the chain.”

For Sotheby’s, these allegations are unfounded, and the auction house is prepared to “vigorously defend itself,” as it told The Art Newspaper.

In recent months, the world of crypto-art has been rocked by numerous disputes, especially concerning intellectual property rights. More and more artists’ works are being illegally reproduced as lines of code to capitalize on this new art market.

The NFT marketplace OpenSea alone recently revealed that 80% of the NFTs created on the platform with its free minting tool were fraudulent, spam or plagiarism.

Faced with the scale of the phenomenon, the Institut Art et Droit recently published a best practice report for auction houses wishing to engage in the NFT business.

“As a technology and a new asset class, NFTs are not yet precisely defined and are therefore not governed by any legal framework, despite national and European attempts.

The fact remains that this market will only be able to develop within the framework of a clearly established legal environment, particularly in terms of taxation, which provides confidence to stakeholders,” it reads [in French].

When it comes to NFTs, it would seem that caution is still the order of the day.